Office Hours

M-F: 9:00am - 5:00pm

Sat: by appointment only

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Would you like to create a personalized quote?

Loren Valdez

Office Hours

M-F: 9:00am - 5:00pm

Sat: by appointment only

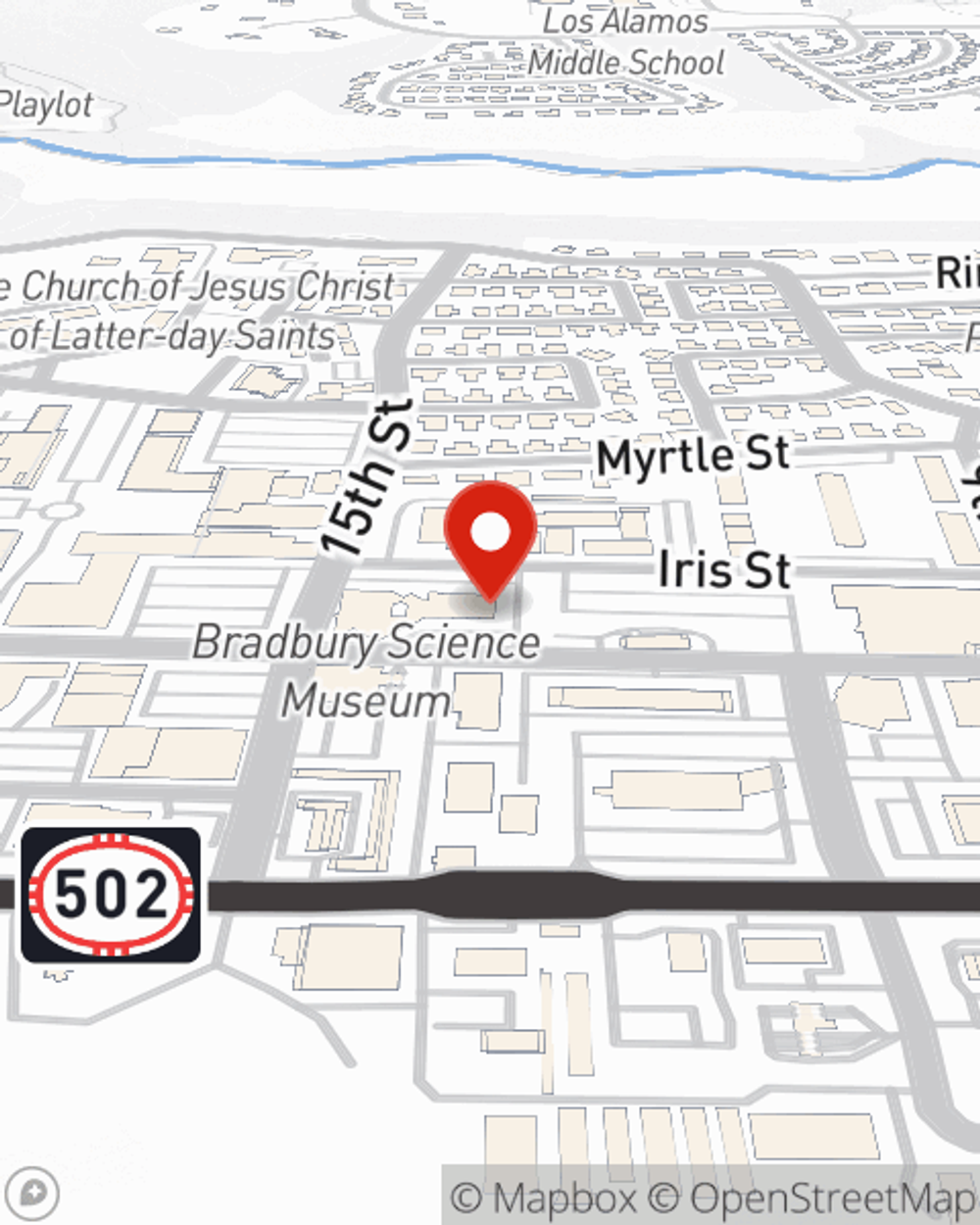

Address

Los Alamos, NM 87544-3218

Attached to the Bradbury Science Museum

Office Hours

M-F: 9:00am - 5:00pm

Sat: by appointment only

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

M-F: 9:00am - 5:00pm

Sat: by appointment only

-

Phone

(505) 662-2200 -

Fax

(505) 662-3493

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Office Info

Office Info

Office Hours

M-F: 9:00am - 5:00pm

Sat: by appointment only

-

Phone

(505) 662-2200 -

Fax

(505) 662-3493

Languages

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

Usage-based car insurance for multiple drivers

Usage-based car insurance for multiple drivers

Learn how usage-based auto insurance works with multiple drivers on one policy and how the combined driving habits may affect costs and potential savings.

Viewing team member 1 of 2

Greg Valdez

License #20066891

Greg has returned to his home state of New Mexico after living in Burbank, California, Chicago, Illinois and Belo Horizonte, Brazil, where he studied and pursued his passion for music. Greg’s welcoming and easygoing personality has allowed him to excel in his new customer acquisition role. Greg enjoys traveling but is always eager to get back home to New Mexico where he loves spending time with family and friends.

Viewing team member 2 of 2

Tiffany Van Newkirk

License #16231560